Dear Investor,

Just a quick update on operations and observations at La Golondrina.

Firstly, in our view, regardless of gold price, the most profitable, scaleable and sustainable gold mines are those that are high-grade, or at-least have accessible areas of higher gold grades. On the one hand that is clearly not rocket science; on the other hand, things are never quite that simple! Bulk tonnage low-grade gold projects are initially expensive earth moving exercises which have such mass and inertia that they are often difficult to turn around in a short period of time. However, they can also be highly profitable in a strong gold environment or as part of a portfolio of mine projects where good production planning can help carry them through the tough times.

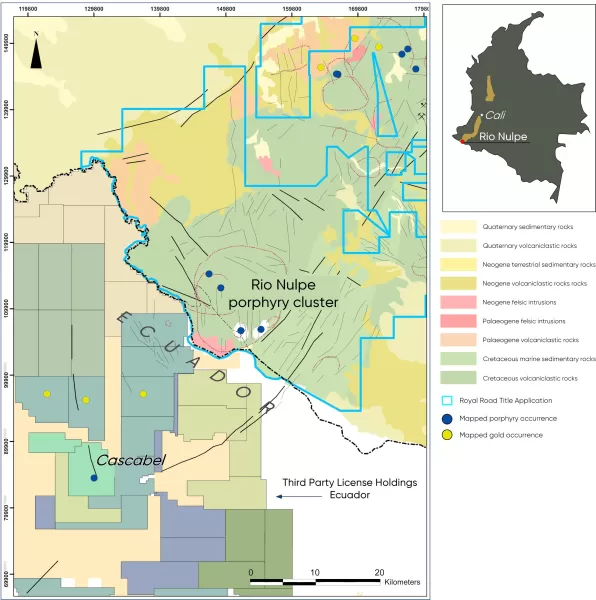

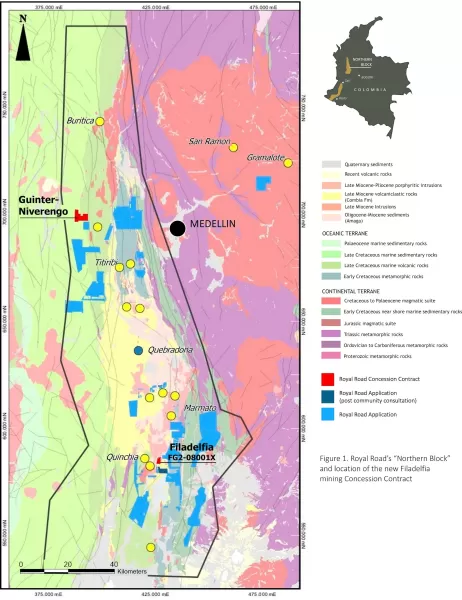

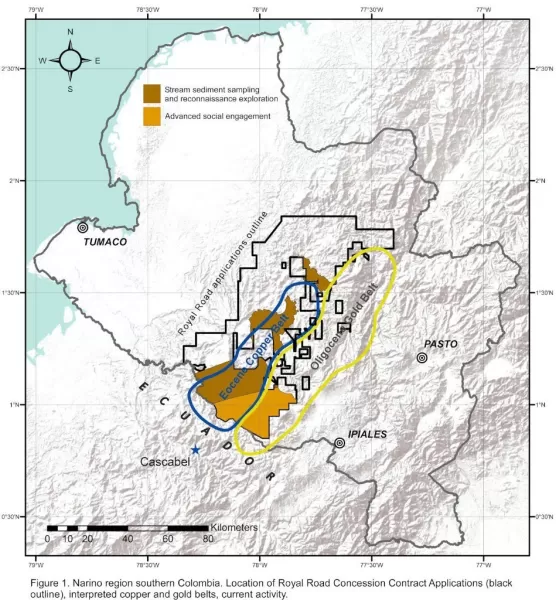

This is production talk from an exploration company but some readers may not know that the mass, inertia and capital demands of bulk tonnage low grade gold projects become evident even at the exploration stage. Basically, the more the gold is spread out and distributed through the host rock, the more drilling and other related costs that are required to define the project as a resource. That means investing a lot of risk capital to define a deposit that at the end of the day will require a lot more initial capital to develop and may ultimately be quite sensitive to gold price. This is not a good stand-alone proposition for a small company or an ideal JV proposition for a small company with a bigger partner that itself does not have the mine project portfolio to carry the project through the hard times; such as these. I think this goes someway at-least to explaining our move from Gömeç to La Golondrina in Colombia.

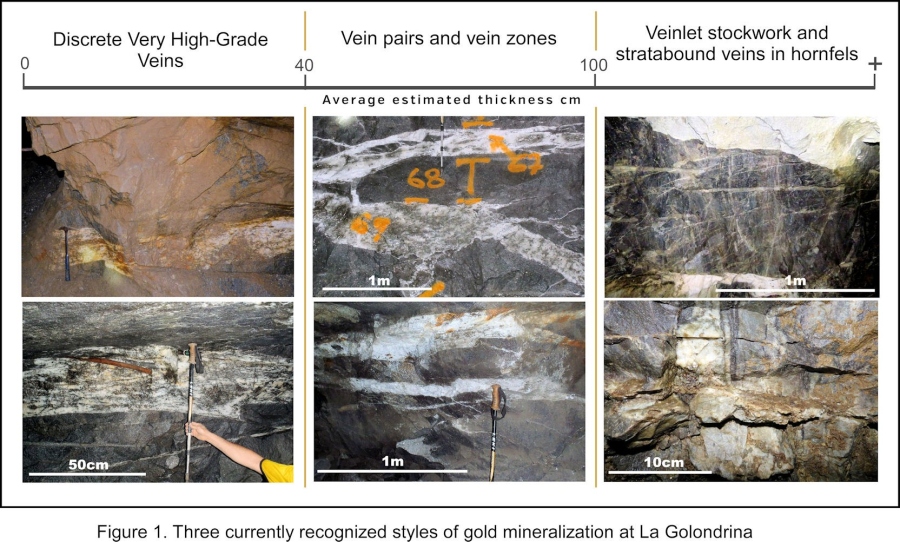

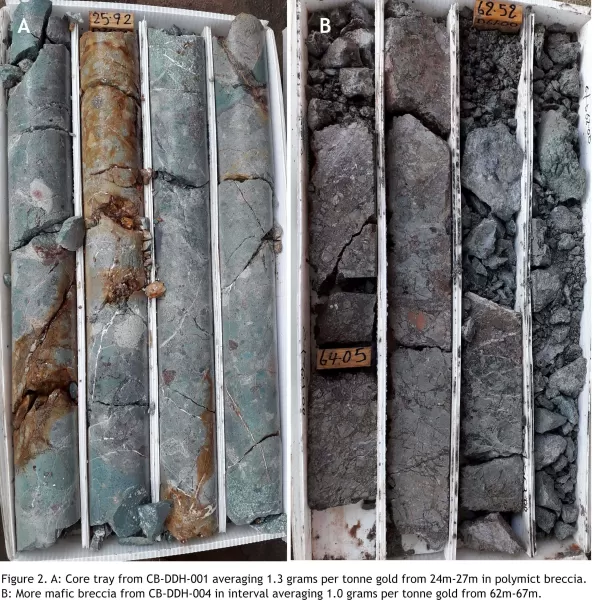

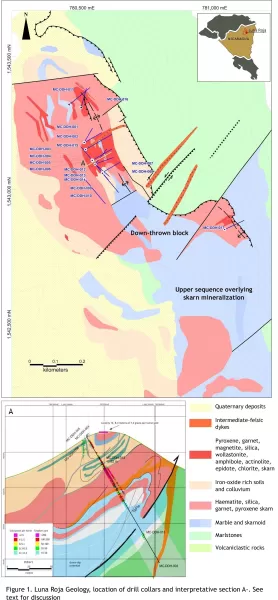

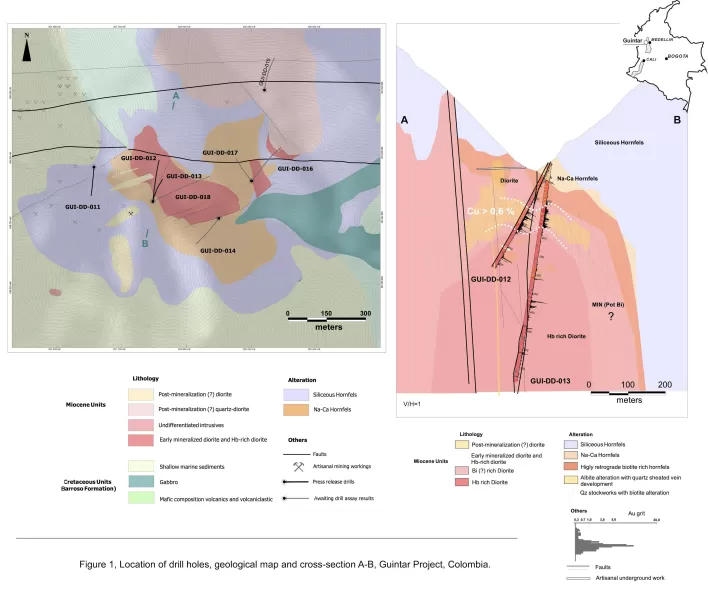

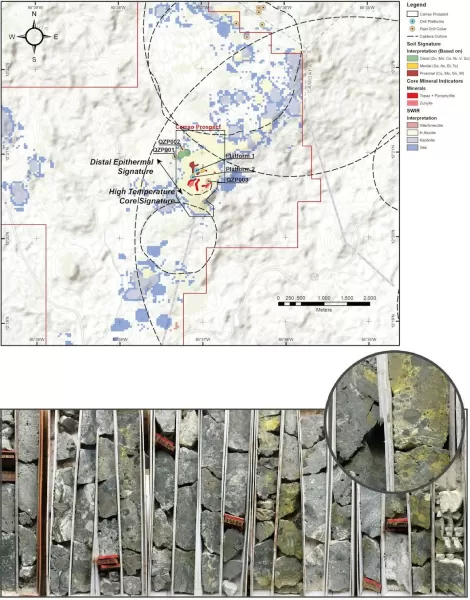

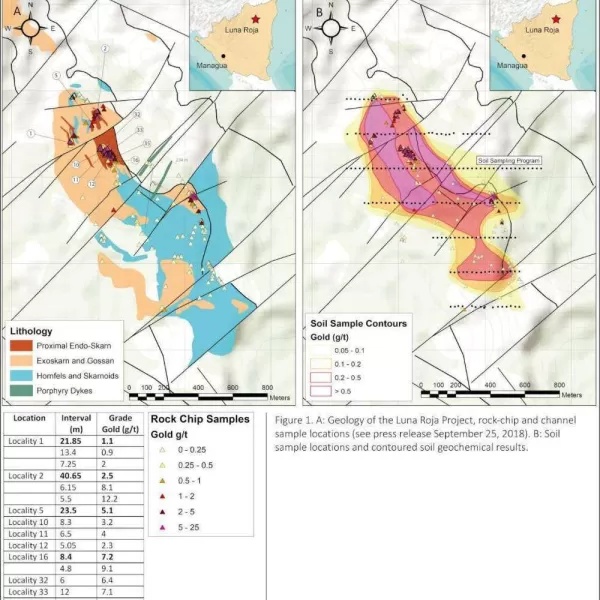

Granted it is early days, but we believe that the gold grade at La Golondrina, the apparent grade distribution and the obvious tonnage potential, gives the project the flexibility and dynamic range to better survive gold price fluctuations. We are looking for a large (plus million ounce) high-grade gold deposit at La Golondrina. Previous rock-chip sampling of vein material returned an average 13g/t gold from 51 samples (up to 64g/t gold) and importantly, continuous rock chip samples from host rock to the veins have returned up to 3.8 g/t gold and 6.8 g/t gold has been returned from a vein-stockwork zone. Basically, whether this is ultimately an open-pit or underground operation, there will generally be a sweet spot of high-grade to carry the margin when the gold price is under pressure.Just now we are conducting saw-cut channel sampling and laser assisted underground surveying at La Golondrina. Those of you following us on Facebook will have seen videos and photographs of this work and some observations to date and some of this detail has been compiled into our recently updated investor presentation which you can download from our web site. Figure 1 (below) is a good summary of the mineralization styles we are observing on site and you can see a video of the channel sampling process here. Basically we seem to be seeing thicker vein zones and paired veins with apparently mineralized (sulphides and veinlets) intervening host rock. We are also seeing some impressive vein stockwork and sulphide zones in hornfels (altered sedimentary rock adjacent to the tonalite). We hope to get the first set of saw-cut channel sample results by the middle of December.

If you are in London during the first week of December (1st to the 3rd) look us up at the Mines and Money conference (Booth E26) or if you want to arrange a one-on-one meeting around that time please email me on tim.coughlin@royalroadminerals.com

Respectfully Yours,

Dr Tim Coughlin

FIGURE 1

STAFF PROFILE:

Héctor Vargas, Managing Director Colombia

MSc Geology, MSEG. Over 35 years experience with vast knowledge on geology and projects in Colombia. Colombia and Latin American Director of Greenstone Resources Ltd and Metallica Resources. Consulted to various major mining companies, Senior Geologist Anglo Gold Colombia 2002 through to 2013. Credited with a number of gold and copper gold discoveries in Colombia including El Alacran (+2Moz eqv)

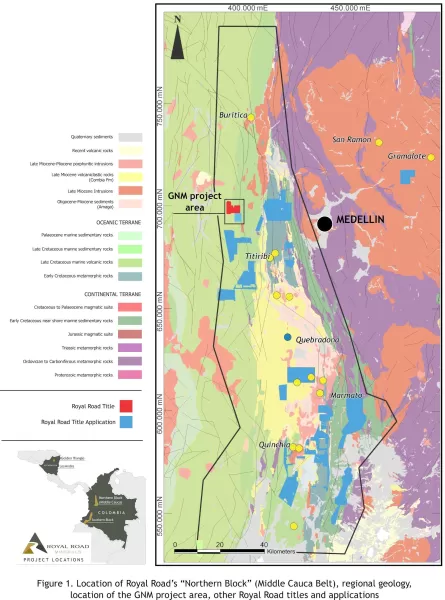

About Royal Road Minerals:

Royal Road Minerals is a gold and copper focused exploration and development company. The Company's recent strategic move to Colombia is to focus on and advance the La Golondrina high-grade gold project under an option agreement to earn 100% of the property.More information can be found on Royal Road Minerals web site at www.royalroadminerals.com