Royal Road Intersects 95 Meters at 1.5 Grams per Tonne, Including 45 Meters at 3.0 Grams Per Tonne Gold at the Luna Roja Product, Nicaragua

Sept 14, 2020

September 14, 2020 – Toronto, Ontario: Royal Road Minerals Limited (TSXV:RYR) (“Royal Road” or the “Company”) is pleased to announce interim drilling results from its diamond drilling campaign at its Luna Roja gold project in northeastern Nicaragua.

The Luna Roja project forms a part of the Company's Strategic-Alliance agreement (see press release; September 6, 2017) with Hemco Mineros Nicaragua (“Hemco” a subsidiary of Colombia’s Grupo Mineros S.A. MINEROS:CB) and is located in the highly prospective Golden Triangle of northeastern Nicaragua, a region that has produced some eight million ounces of gold since the early 1900's. Hemco Mineros Nicaragua own and operate the Bonanza gold mine which is located approximately 26 kilometers to the northwest of Luna Roja. Royal Road Minerals is operator of the Strategic Alliance.

In 2019, Royal Road and Hemco completed an initial 17-hole (2472 meter) scout drilling program at Luna Roja (see press release October 2nd 2019) . This was the first drilling program to be completed on the project. Promising results included; LR-DDH-3, 49m at 2.8 g/t gold (including 22m at 5.3 g/t gold); LR-DDH-12, 49m at 2.4 g/t gold, (including 18m at 5.4 g/t gold) and LR-DDH-016, 69m at 1.5 g/t gold (including 15m at 2.5 g/t gold).

A follow-up drilling program commenced at Luna Roja on May 2nd of this year. The initial stage of this program comprises approximately 3000 meters of diamond drilling aimed at locally extending known gold mineralization and exploring newly identified and deeper targets identified by ground microgravity. Initial results from this drilling program returned significant results including LR-DDH-22, 65m at 6.9 g/t gold (including 41 meters at 10.0 g/t gold- see press release July 13 2020).

Results have been returned for a further 6 drill-holes (see Table 1; intersections are not true widths and the Company does not have sufficient information to make a determination of the true widths of the drill hole intersections of the mineralized zones). Significant intersections include:

LR-DDH-29 18m at 1.0 g/t gold

LR-DDH-30 95m at 1.5 g/t gold (including 45 meters at 3.0 g/t gold)

LR-DDH-33 18m at 0.9 g/t gold

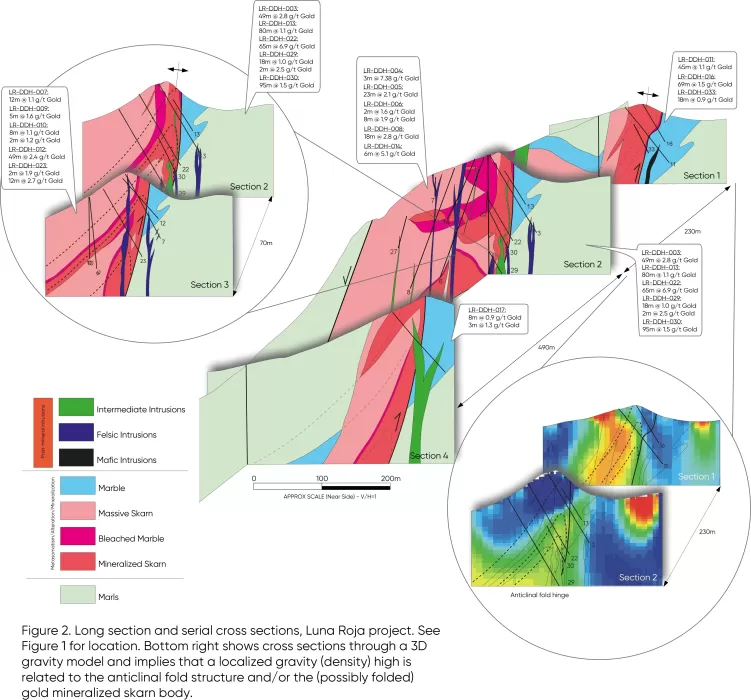

LR-DDH-34 18m at 1.1 g/t gold

Drill results received to-date, support the interpretation that gold mineralization extends at depth and down plunge towards the northwest at Luna Roja. This is consistent with the orientation of the anticlinal fold structure which is believed to be the primary structural control to gold mineralization at the project (see Figures 1 and 2). Drill hole LR-DDH-34 in the northwest of the project area intersected gold mineralization at a distance of approximately 200 meters across strike from the gold mineralized anticlinal fold structure. This drill hole has identified what may be a new gold mineralized zone at Luna Roja or the folded and/or perhaps faulted continuation of known gold mineralization.

The initial 3000m follow-up drilling program at Luna Roja is now complete and whilst the Company awaits further drilling results, compiles and interprets geological information, the drilling rig has relocated 16 kilometers to the south of Luna Roja to commence a 1500 meter follow-up drilling program on the Company’s Caribe project (See press release October 7, 2019).

“This initial follow-up drilling program was comprised primarily of step-out holes and conceptual drilling aimed at extending gold mineralization along-strike and at depth and testing interpreted geophysical targets” said Dr Tim Coughlin, Royal Road’s President and CEO. “We are still awaiting final results, but at this stage the system remains continuously open along strike to the north and at depth. In the south, where we interpret the system to be downthrown and offset by faulting, we have yet to drill-test a deep circular gravity high feature and although a modest intersection, drill hole 34 in the north has raised some interesting questions regarding the across-strike potential of the system. Our plan is to conclude the drilling at Caribe and then return the drill rig to Luna Roja for a further drilling program aimed at testing well-defined targets and resolving resource potential.”

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

The information in this news release was compiled, reviewed and verified by Dr. Tim Coughlin, BSc (Geology), MSc (Exploration and Mining), PhD (Structural Geology), FAusIMM, President and CEO of Royal Road Minerals Ltd and a qualified person as defined by National Instrument 43-101. Royal Road Minerals employees are instructed to follow standard operating and quality assurance procedures intended to ensure that all sampling techniques and sample results meet international reporting standards. More information can be found on Royal Road Minerals web site at www.royalroadminerals.com

Quality Assurance and Quality Control:

Diamond drill core is cut in half over 1-meter downhole intervals using a core saw. Samples are prepared and assayed by independent and ISO accredited laboratories of Bureau Veritas Minerals (BVM) and their local subsidiaries. Bagged 1-meter samples are collected from site and delivered to BVM sample preparation laboratories in Managua. Samples are prepared using the BVM codes PRP70-250 plus PUL85, where samples are crushed to 70% less than two millimeters, a riffle split of 250 grams is collected and then pulverized to better than 85 per cent passing 75 microns. Prepared sample pulps are then sent for analysis to BVM labs in Vancouver Canada. Gold is analyzed by fire assay with an atomic absorption finish and a measurement range of 0.005 to 10 ppm. Samples over 10-ppm gold are re-analyzed by fire assay with a gravimetric finish. Multielement concentrations are analyzed by four-acid digestion and inductively coupled plasma mass spectrometer. Samples over 10,000ppm Cu, Zn, Pb or Mn and 200 ppm W, are re-analyzed with four acid digestion and Inductively Coupled Plasma Emission Spectrometer (ICP-ES). Commercially prepared standards (gold-copper pulps), blanks (pulps and coarse chips) and field duplicates are inserted into the sample stream by Royal Road Minerals for a total of 15% QA/QC to ensure sample precision. In the case of duplicate analyses of a sample, the average of both analyses is used as the final reported value. Unless otherwise stated, gold grades are not capped for calculation of length-weighted averages.

Cautionary statement:

This news release contains certain statements that constitute forward-looking information and forward-looking statements within the meaning of applicable securities laws (collectively, “forward-looking statements”) including statements relating to the Hemco-Mineros Alliance and those describing the Company’s future plans and the expectations of its management that a stated result or condition will occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of the Company, or developments in the Company’s business or in the mineral resources industry, or with respect to the Hemco-Mineros Alliance, to differ materially from the anticipated results, performance, achievements or developments expressed or implied by such forward-looking statements. Forward-looking statements include all disclosure regarding possible events, conditions or results of operations that is based on assumptions about, among other things, future economic conditions and courses of action, and assumptions related to government approvals, and anticipated costs and expenditures. The words “plans”, “prospective”, “expect”, “intend”, “intends to” and similar expressions identify forward looking statements, which may also include, without limitation, any statement relating to future events, conditions or circumstances. Forward-looking statements of the Company contained in this news release, which may prove to be incorrect, include, but are not limited to, those related to the Hemco-Mineros Alliance, Hemco-Mineros, and the Company’s plans exploration plans.

The Company cautions you not to place undue reliance upon any such forward-looking statements, which speak only as of the date they are made. There is no guarantee that the anticipated benefits of the Hemco-Mineros Alliance and the Company’s business plans or operations will be achieved. The risks and uncertainties that may affect forward-looking statements include, among others: economic market conditions, anticipated costs and expenditures, government approvals, and other risks detailed from time to time in the Company’s filings with Canadian provincial securities regulators or other applicable regulatory authorities. Forward-looking statements included herein are based on the current plans, estimates, projections, beliefs and opinions of the Company management and, in part, on information provided to the Company by Hemco-Mineros, and, except as required by law, the Company does not undertake any obligation to update forward-looking statements should assumptions related to these plans, estimates, projections, beliefs and opinions change.

For further information please contact:

Investor Relations

USA-Canada toll free: +1-800-638-9205

Phone: +44 (0)1534 887166

info@royalroadminerals.com

In Colombia Royal Road Minerals operates through its wholly-owned Colombian companies Minerales Camino Real SAS founded in 2015 and Exploraciones Northern Colombia SAS acquired from previous owners in 2019. In Saudi Arabia Royal Road Minerals operates through its 50% owned Saudi Arabian registered subsidiary, Royal Road Arabia. In Morocco Royal Road Minerals operates through its 100% owned subsidiary Minéraux Chemin Réel SARL AU.

Copyright 2026. Royal Road. All rights reserved